- #DOUBLE ENTRY BOOKKEEPING VS DOUBLE ENTRY ACCOUNTING FULL#

- #DOUBLE ENTRY BOOKKEEPING VS DOUBLE ENTRY ACCOUNTING TRIAL#

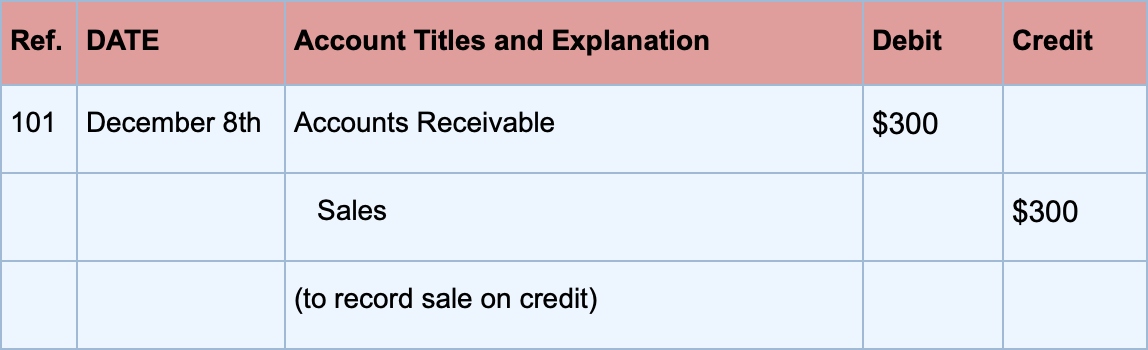

The typical accounting method for public companies is double-entry accounting, which meets GAAP requirements. Its financial records show prospective investors that your company has followed standard accounting practices. The first important thing to note is that the double-entry accounting system is the Generally Accepted Accounting Principles (GAAP) complaint. However, you should ask yourself a valid question: How do I decide whether double-entry accounting is right for my business? Knowing the stated basic rule is excellent. Under the double-entry system, revenues must always equal expenses. You should put the debit entry for a transaction on the left side of the general journal, while the credit entry will be on the right side of the journal. So, the logical question would be, What is the basic rule of double-entry bookkeeping?Įvery transaction entered in your journal involves a debit entry in one account and a credit entry in another. This approach is different from single-entry. The table above shows us how each transaction entry has a debit and credit. The simple rule for double-entry ensures that any amount recorded as a debit must be equal to that recorded as a credit.Ī double-entry accounting system is an accounting system that works on the basic accounting equation:įollowing the earlier example used in single-entry accounting, here’s a presentation of the same data in a double-entry accounting system. Unlike Single-entry accounting, the double-entry accounting system records each transaction twice–as a debit or credit. Get Started with Double-Entry Accounting What is double-entry accounting? Having presented a good case for single-entry accounting, we’ll look at double-entry accounting. You’ll have challenges working with the single-entry system. Unacceptable to Tax Authorities: Generally, tax authorities do not accept Single Entry Systems because these books are not maintained by following universally and lawfully accepted accounting principles. This gives room for undetectable errors and fraud. This gives room for misappropriation and embezzlement of assets.ĭifficult to detect errors and frauds: Using a single-entry bookkeeping system doesn’t allow you to follow the rules of proper accounting–the books of accounts fail to reveal the clear financial picture of your business. Lack of Control over the Assets: Since you do not prepare real or nominal accounts, keeping a detailed track of assets is challenging. Its inability to reveal the actual profit or loss figures limits you from assessing the actual performance of your business.Īlso, it fails to provide a comparative analysis, which hampers the adequate measure of your current year’s performance with that of the previous year.

#DOUBLE ENTRY BOOKKEEPING VS DOUBLE ENTRY ACCOUNTING TRIAL#

Limits with arithmetic accuracy: Because the single-entry bookkeeping system doesn’t require a trial Balance, it’s challenging to check for arithmetical accuracy.Ĭan’t measure business performance: For a business whose success is measured in terms of profits and losses, the Single Entry System possesses a limitation. There are limits to what a business can achieve with single-entry bookkeeping.

Although it best fits small businesses, that doesn’t mean there aren’t advantages–simplicity is the most effective form of sophistication. These questions will help you decide if a single-entry accounting method is suitable for you. Do you have a few physical assets like buildings, equipment, and vehicles?.

#DOUBLE ENTRY BOOKKEEPING VS DOUBLE ENTRY ACCOUNTING FULL#

Under single-entry accounting or bookkeeping, expenses are recorded at purchase, while revenue is recorded at the sale.

At the end of your accounting week, there’s a balance of $195,000. The table shows cashbook entries with specific dates, helping you keep track of your expenses and income.

0 kommentar(er)

0 kommentar(er)